The big picture: Financial reports released by the world’s largest mobile carriers in the first quarter show significant growth in fixed wireless access (FWA) customers – the clearest signal yet that 5G, which allows homes and businesses to connect to the internet through radio frequencies instead of cables, is gaining serious momentum.

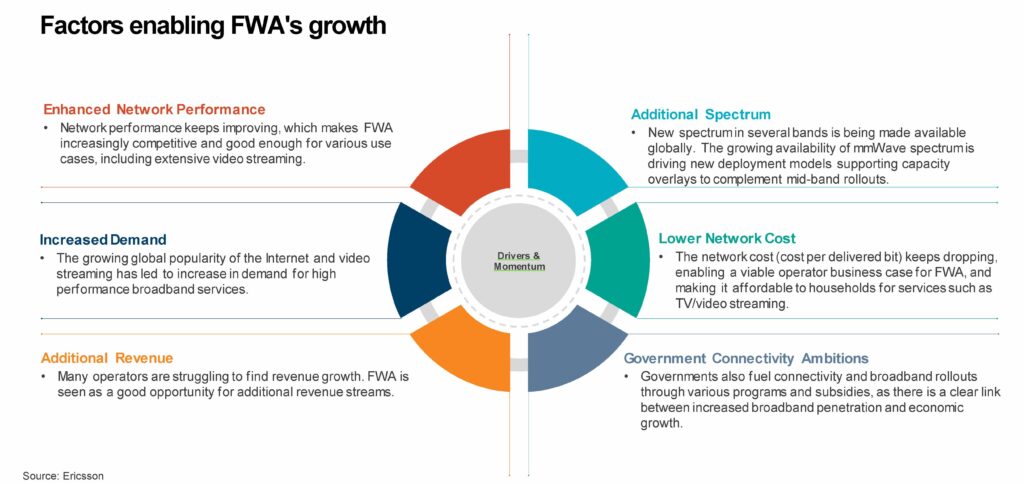

A number of factors are enabling FWA’s growth, including:

- Continued demand for high-speed internet connectivity from consumers and businesses alike

- 5G’s super-fast speed, massive capacity and ultra-low latency, which makes it a realistic alternative to traditional wireline broadband service

- Significantly lower last-mile expenses, which means it is cost-effective for wireless carriers to offer high-speed mobile broadband in previously underserved areas

- 5G’s efficient operation, allowing for competitive broadband prices

- Additional spectrum, which enables a balance of wide coverage and performance

Of these factors, FWA’s ability to incorporate larger 5G technology for speed, security and reliability is its biggest appeal for end users, as it offers a true alternative to traditional wireline broadband providers. For carriers, FWA is opening up new markets and opportunities they previously were unable to compete in. According to industry research published by Ericsson, the global 5G FWA market is expected to jump from $27 billion in 2022 to $67 billion by 2028.

Why is FWA making huge waves? The answer varies depending on the constituency – and there are many constituencies. For mobile operators, it is an opportunity to increase topline revenue by penetrating previously underserved markets for both households and enterprises worldwide and competing directly against traditional wireline broadband providers. It is ideal for household customers looking for an alternative to cable or DSL, including people with secondary homes who want portable broadband connectivity so they can move to a different location for leisure or work. Unconnected homes in underserved markets or rural areas are particularly suited for FWA, which promises to bridge the digital divide and improve equity for underserved, low-income areas.

The reliance of enterprises on high-speed, high-availability internet access continues to increase due to the growing adoption of emerging technologies such as the Internet of Things (IoT), artificial intelligence, the metaverse, virtual reality, automation and robotics. Those enterprises are excited about FWA’s promise of continuous, secure and low-latency connectivity.

For instance, small and medium-size businesses in areas with mobile coverage that are either underserved by cable and fiber or stuck with expensive monthly broadband costs, can satisfy their broadband needs with FWA, which can deliver more capacity over greater distances at speeds as high as 1 Gbps at often lower monthly cost. Within these digital deserts, FWA can leverage existing mobile network infrastructure (e.g., main sites, cell towers) and the significant investment in 5G infrastructure that the wireless carriers are building out across mid-and-high-band spectrums to meet growing demand. To learn more about the transformative potential of 5G, read our research report, The 5G Effect.

Picture this: A modern industrial 20,000-square foot warehouse facility, with fewer than 50 employees and in a rural area, which relies heavily on real-time internet connectivity for order processing, inventory management, shipping and receiving updates, worker communication, 24-hour video security, and employee engagement. Historically, such facilities have had limited choices. Wireline broadband speeds are slow, satellite is unreliable and cost prohibitive, and laying new fiber optic wire to the building is expensive, if even an option. This facility would be an ideal place to take advantage of the new 5G network and deploy a 5G FWA for faster data speeds, large capacity, embedded security and privacy tools, and improved reliability.

What they are saying: During AT&T’s first-quarter earnings call last month, CEO John Stankey stated that many businesses would also benefit from fixed wireless bundled in with other wireless services “for a long period of time to come.”

Similarly, on Verizon’s recent first quarter earnings call, CEO Hans Vestberg said its business customers are increasingly turning to FWA as their primary source of broadband connectivity, “won over by the reliability and the overall value of the product.” Verizon is seeing new use cases across all its customer groups as they leverage the flexibility of FWA to expand beyond what traditional wired broadband can do.

Also, T-Mobile’s Mike Katz described FWA as “one of the big killer apps for 5G” and added that the technology “is the first high-speed option” for many of its customers in rural areas.

These projections notwithstanding, FWA, like any new technology, has challenges, including these:

- Spectrum dependency – The speed and efficiency at which wireless carriers are able to deploy and offer high-speed 5G services is directly tied to their access to limited spectrum.

- Coverage and propagation – The higher 5G frequencies (mmWave) that bring the fastest speeds cover a smaller distance from the towers and are more susceptible to interference from factors like foliage, snow, rain and other environmental changes.

- Zoning restrictions – Local and state zoning approvals are required to install radio units in certain neighborhoods, a process that often requires holding public hearings and can take time to complete.

- Need for standardization – As the technology and the market grow, there will be a continued need for standardization across the FWA market to enable a robust ecosystem where all industry stakeholders (governments, service providers, equipment manufacturers and semiconductor vendors) can operate under a common 5G standard to bring down costs.

What’s next: The good news is that operators are working hard to address the challenges to wider FWA adoption. On the issue of limited availability of high-frequency radio signals, for example, wireless carriers are counting on extended-range mmWave spectrum (above 20GHz) to drive new deployment models. Improved mmWave technology, including repeaters and other forms of signal boosters to improve coverage, will expand the addressable market for gigabit FWA. Other 5G innovations include features that allow usability with integrated mesh Wi-Fi and self-install capabilities to reduce barriers to deployment.

In order to save costs associated with dispatching installation technicians in impoverished areas and potentially triggering cancellations from disappointed customers, some operators are employing RF assessment technology that leverages portable RF units and artificial intelligence to identify 5G service availability in different geographic areas.

The bottom line: FWA will continue to gain significant momentum as additional coverage in the mid-band and mmWave spectrum is deployed more broadly and 5G technology continues to advance. For businesses across different industries and various sizes, it is time to assess whether FWA will be a game changer for your organization, in terms of either enhancing or replacing existing broadband connectivity. In many cases, a connectivity-strategy review may be a requisite first step in this assessment process. One thing is for sure: The change in consumer behavior witnessed across all sectors during the pandemic will continue to drive new types of 5G services and use cases, of which FWA’s speed, security and reliability will be its most significant benefit.

Add comment